From Portfolio Data to Actionable Insight: A Portfolio Health Concept for a Regulated Investment App

Helping financially inexperienced users understand diversification and concentration risk — without giving financial advice.

Dec 2025 | UX and UI design

Framing

Portfolio health isn’t obvious

Performance metrics don’t reveal true gains, losses, or overall health.

Risk lacks visibility

Abstract numbers hide concentration and real exposure.

Action signals are unclear

Fragmented views make it hard to know whether to act or wait.

User outcomes

Clear understanding

Confidence without pressure

Action clarity

Product success metrics

Adoption & awareness

Behaviour change

Long-term outcome

Business impact

Improved AUM quality

Higher retention

Sustainable revenue growth

Explored the information architecture and layouts to make it consistent and scalable.

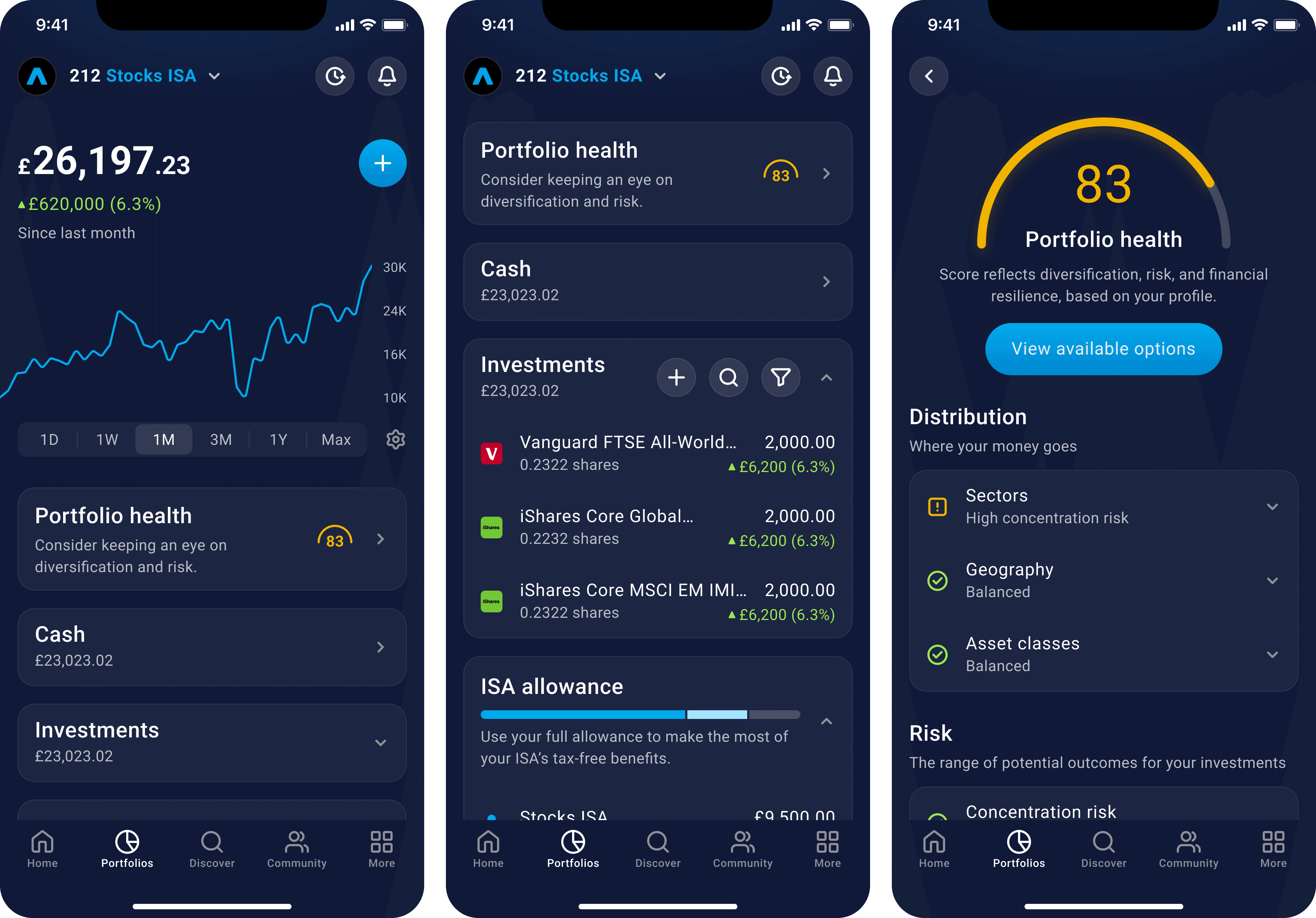

Concept A — Holistic, unified portfolio view

A consolidated health perspective across accounts

Anchors users with a clear total value, while providing light performance context without encouraging reactive behaviour.

Clarifies where funds are held, grounding portfolio changes in familiar account structures before introducing higher-level health signals.

Condenses diversification and risk into a simple signal that invites exploration.

The Portfolio Health score provides a high-level quality signal based on aggregated holdings and the user’s profile, with optional deeper exploration.

Distribution, Risk, and Stability break the score into clear dimensions, helping users understand what’s driving it. Together, they turn an abstract metric into explainable signals without overwhelming detail.

The score reflects user-specific assumptions, not an absolute truth, so making them visible improves transparency and trust.

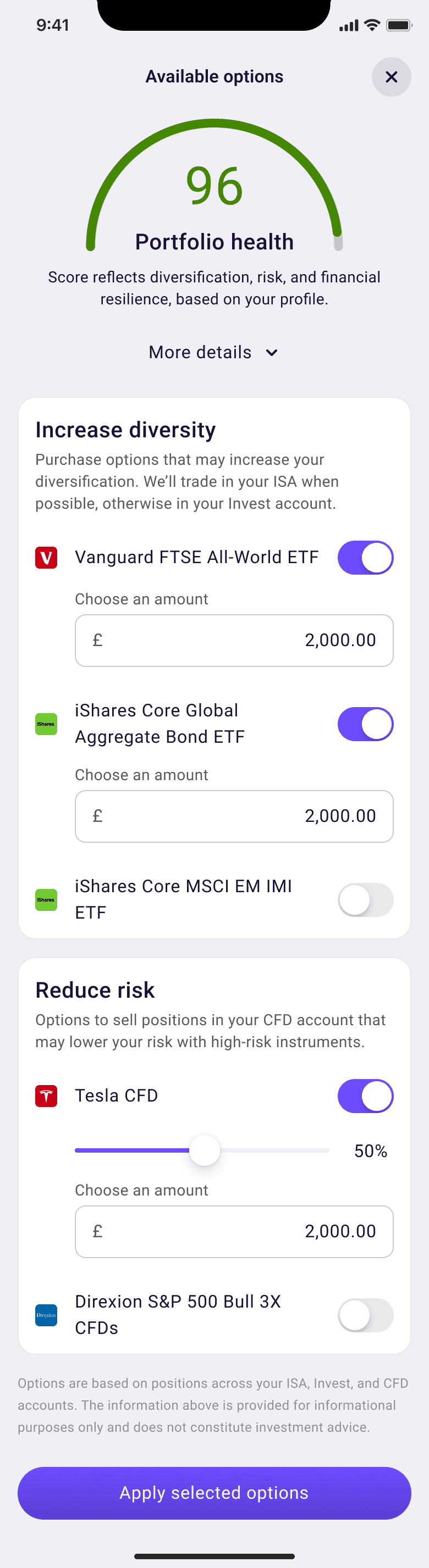

Options update the score in real time, while detailed breakdowns are progressively disclosed to avoid cognitive overload.

Actions are presented as reversible previews, letting users explore potential impact without committing to a trade.

Final execution always happens through the standard trading confirmation flow.

Intentionally designed to separate insight from advice, enabling confident self-directed decisions while remaining compliant with FCA guidelines.

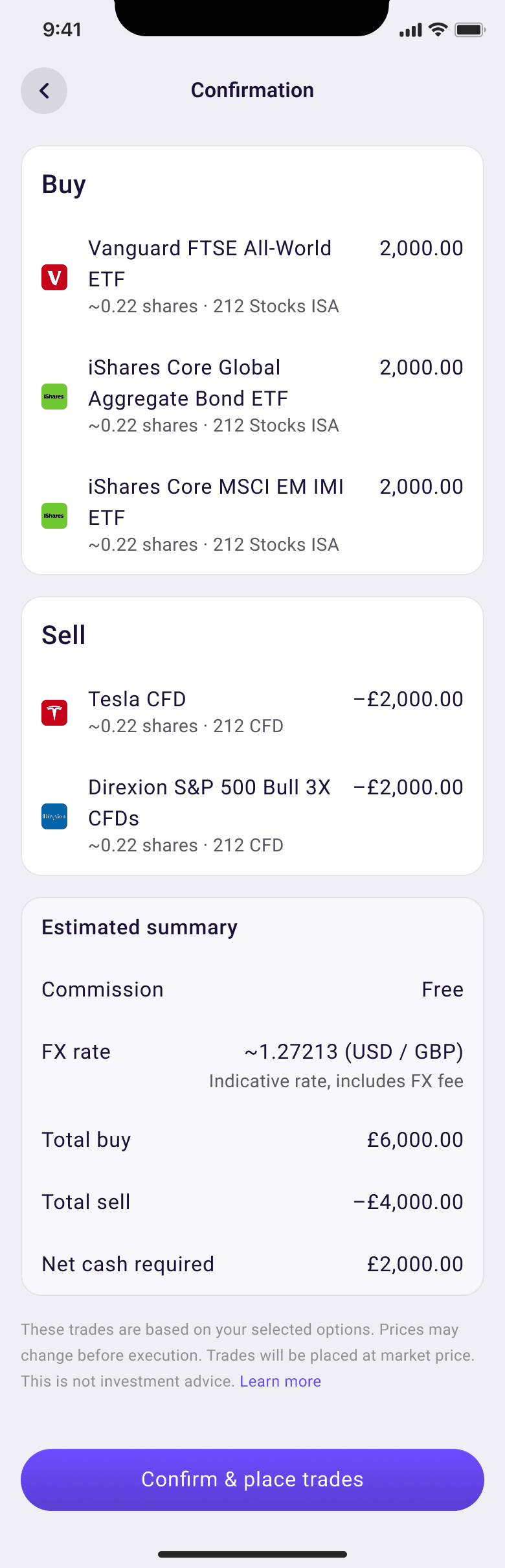

This section clearly lists the trades that will be executed, allowing users to verify buy and sell actions before confirming.

This section summarises the resulting cash movement, FX conversion, and fees, making the financial outcome explicit before execution.

A neutral illustration provides immediate confirmation and a calm sense of completion, without implying investment outcomes.

Closes the flow by returning users to portfolio health, where they can review the impact of their changes.